Defynance Fund Performance at a Glance

14.93%

NET RETURN

0.48%

VOLATILITY

2.24

SHARPE RATIO

12.19%

ALPHA

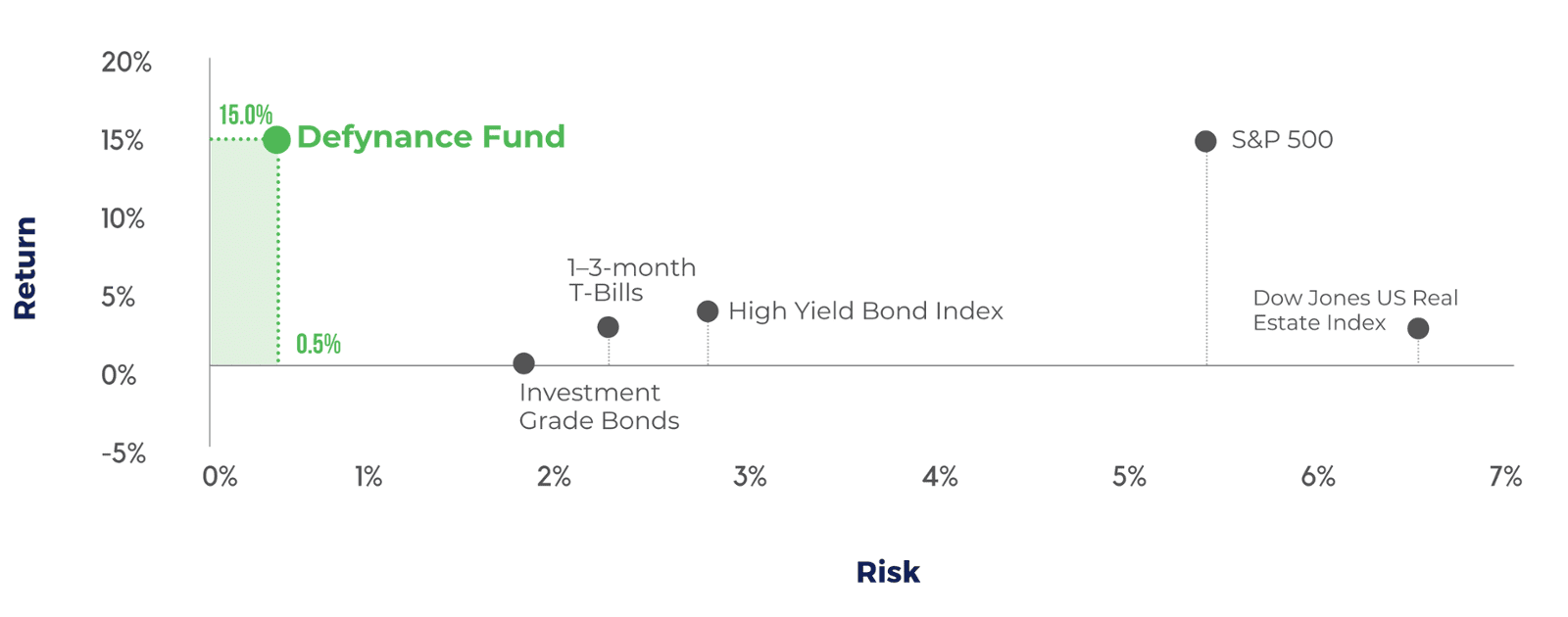

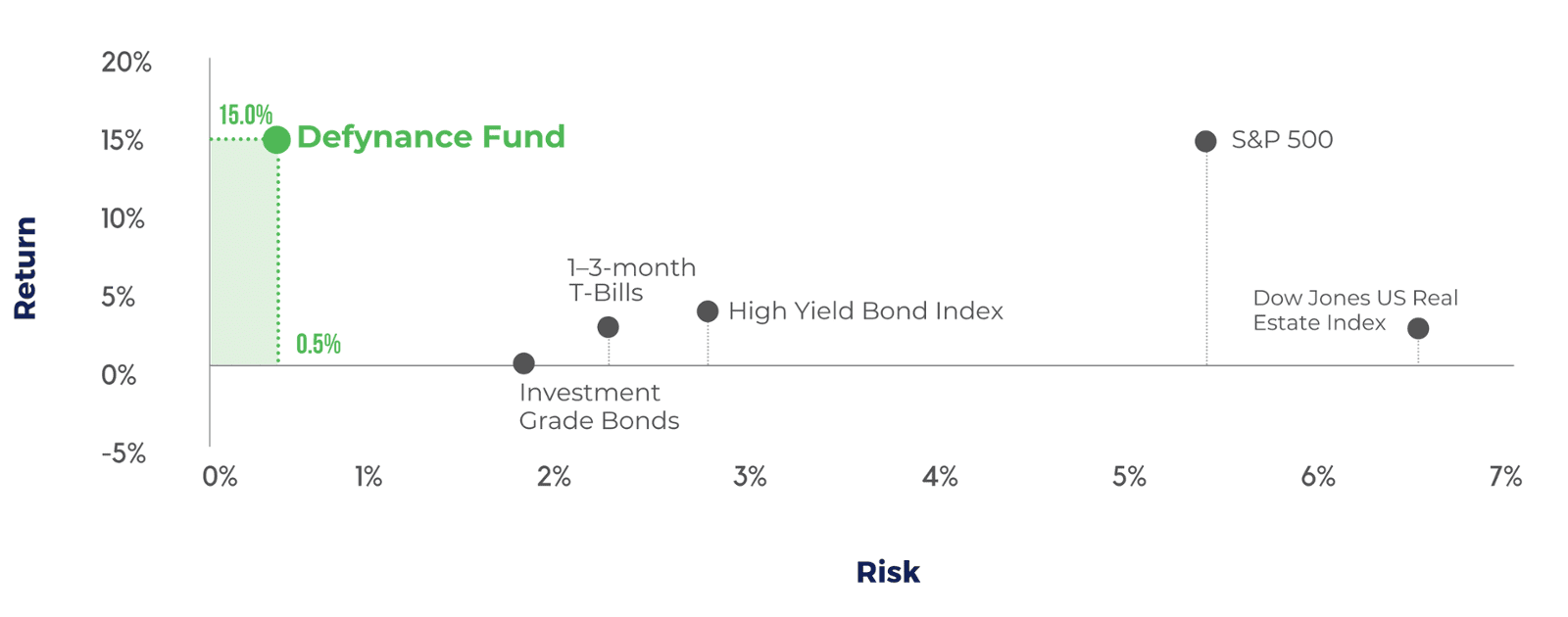

Exceptional Performance, Minimal Volatility

Built to deliver income-based growth across all market cycles

How the Defynance Fund Works?

Fuel income growth, reduce risk, and drive change—all by removing student debt

14.93%

NET RETURN

0.48%

VOLATILITY

2.24

SHARPE RATIO

12.19%

ALPHA

Built to deliver income-based growth across all market cycles

Unlock deeper insights into fund performance, portfolio composition, and

investor tools—exclusive to our Member Portal

You'll receive an email invitation with access instructions. If it doesn’t arrive within a few minutes, please check your junk or spam folder.

Discover how income-based returns and impact investing can work together to deliver powerful results

Traditional loans grow with interest. Our model replace debt with sustainable, income-based repayment.

Income-based repayment, career support, and our proprietary PRAIS™ algorithm reduce risk

You earn more only when customers earn more—incentives fully mutually aligned with performance

Returns are sourced from a pool of diverse occupations, industries, geographies, and more

Your capital drives both impact and performance, creating value for all stakeholders

Diversify your portfolio with an uncorrelated, low-volatility, purpose-built income fund